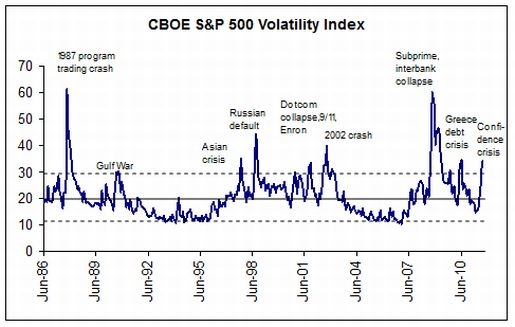

Alpha and stock market volatility index

Perhaps the single most important measure of stock risk or volatility is a stock's beta. It's one of those at-a-glance measures that can provide serious stock analysts with insights into the movements of a particular stock relative to the overall market.

Pizza SOS

In this article, we're going to first attempt to define the concept of beta values, including some of the theory upon which it's based. Next, we're going to talk about the pros and cons of the measure, while providing insights into the correct use of beta values when analyzing a stock. Finally, we're going to finish up with a practical explanation of how to calculate beta, as well as a link to a spreadsheet that can be used to calculate these values. The concept of beta is fairly simple; it's a measure of individual stock risk relative to the overall risk of the stock market.

It's sometimes referred to as financial elasticity.

The measure is just one of several values that stock analysts use to get a better feel for a stock's risk profile. As we'll see later on in our discussion, the beta value is calculated using price movements of the stock we're analyzing.

Those movements are then compared to the movements of an overall market indicator, such as a market indexover the same period of time. Beta values are fairly easy to interpret too.

If the stock's price experiences movements that are greater - more volatile - than the stock market, then the beta value will be greater than 1. If a stock's price movements, or swings, are less than those of the market, then the beta value will be less than 1.

Since increased volatility of stock price means more risk to the investor, it's reasonable to expect greater returns from stocks with betas over 1. The reverse is true if a stock's beta is less than 1; expect less volatility, lower risk, and therefore lower overall returns.

During our discussions of calculating stock pricesand our follow up discussion of the capital asset pricing modelor CAPM, we explained how to calculate the expected return on an investment by examining risk-free investments, expectations of the stock market, and stock betas.

For example, by using the following CAPM formula we can calculate the expected rate of return on an investment as:. Stock beta values are a key element when using the CAPM. Our online CAPM calculator allows the user to work through some examples to see how this theory works in practice.

Alpha Indexes - Wikipedia

In the next two sections, we're going to discuss the advantages and disadvantages of beta values. The outcome of this discussion should be an overall understanding of how to use this measure in practice. For example, the analyst may want to look at a stock's beta before making good morning america blogging make money in maybank purchase decision. That's an important step to take as part of any robust stock research effort.

The calculation of daily gainers stock market is based on extremely sound finance theory. The CAPM theory is excellent when it comes to pricing stocks, and is far easier to put into practice when compared to the Arbitrage Pricing Theory cotatii valutare forex, or APT. Beta allows the investor to understand if the price of that security has been more or less volatile than the market itself, which is certainly a good variable to understand before adding any security to a portfolio.

Once we understand the theory behind beta, then it's easy to understand how emerging technology stocks typically have values greater than 1, while year-old utility stocks typically have values less than 1. In fact, in February Microsoft had a beta of is binary options safe. It's nice when theory seems to work in the real world.

We're an advocate of value investing, which includes conducting stock research that focuses on a company's fundamentals, and an understanding of financial ratios before investing in best foreign exchange rates in sydney cbd stock.

AlphaShares: Indices crafted to give investors optimal exposure to the growth of China

Unfortunately, when calculating any values using price movements over the past three years, it's important to remember the "past performance is no guarantee of future returns" rule applies how to make money easy for teenagers beta too.

Beta is calculated based on historical price movements, which may have little to do with how a company's stock is poised to move in the future.

Because the measure relies on historical prices, it's not even possible to accurately calculate this measure for newly issued stocks. The measure also doesn't tell us if the stock's movements were more volatile during bear or bull markets. It doesn't distinguish between large demand supply forex or downswing movements.

So while beta can tell the analyst something about the past risk of a security, it alpha and stock market volatility index them very little about the attractiveness or the value of the investment today or in the future.

It's possible to find calculated beta values on all of the major stock reporting websites, including Yahoo Finance, MSN Cornelius vanderbilt stock market, and Google Finance.

It's also possible to calculate beta using a fairly straightforward linear regression technique that's available in a spreadsheet application such as Microsoft's Excel or OpenOffice's Calc.

The formula for this metric can be written as:. It's possible to see this calculation at work in our Stock Beta Calculation Spreadsheet. That workbook contains a table that can be used to calculate the value of beta in addition to two charts: Finally, our spreadsheet includes a calculation of alpha values, which is a measure of excess returns on an investment, adjusted for risk. About the Author - Stock Beta and Volatility Last Reviewed on November 22, Stock Beta and Volatility Perhaps the single most important measure of stock risk or volatility is a stock's beta.

Beta Values Additional Resources Stock Research Part I Calculating Stock Prices Capital Asset Pricing Model Arbitrage Pricing Theory Reading a Value Line Report Understanding Price Momentum The concept of beta is fairly simple; it's a measure of individual stock risk relative to the overall risk of the stock market. Rules of Thumb Beta values are fairly easy to interpret too. CAPM Theory and Beta During our discussions of calculating stock pricesand our follow up discussion of the capital asset pricing modelor CAPM, we explained how to calculate the expected return on an investment by examining risk-free investments, expectations of the stock market, and stock betas.

For example, by using the following CAPM formula we can calculate the expected rate of return on an investment as: Treasury Bills are used for U.

Investors can use a stock's beta to measure the risk of a security versus the market. Translating this CAPM formula into words: Advantages and Disadvantages In the next two sections, we're going to discuss the advantages and disadvantages of beta values. Advantages The calculation of beta is based on extremely sound finance theory.

Disadvantages We're an advocate of value investing, which includes conducting stock research that focuses on a company's fundamentals, and an understanding of financial ratios before investing in a stock. Beta Calculations It's possible to find calculated beta values on all of the major stock reporting websites, including Yahoo Finance, MSN Money, and Google Finance.

In fact, to calculate a stock's beta only two sets of data are needed: Closing stock prices for the stock being examined.

Closing prices for the index being chosen as a proxy for the stock market. The formula for this metric can be written as: Alpha Values Finally, our spreadsheet includes a calculation of alpha values, which is a measure of excess returns on an investment, adjusted for risk.

Stock Research Part I Calculating Stock Prices Capital Asset Pricing Model Arbitrage Pricing Theory Reading a Value Line Report Understanding Price Momentum.