Cornelius vanderbilt stock market

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

Cornelius Vanderbilt was the richest and most powerful man in America when he died in Had he liquidated his holdings, it would have taken a fifth of the nation's money supply to buy his assets. How did he get so rich?

Over the previous eight decades, he built empires in steamships and railroads, abandoning the former just as the latter assumed the central role in the movement of goods and people from one side of the country to the other.

More to the point, he built these empires by exploiting the emotional irrationality of others.

Cornelius Vanderbilt - Facts & Summary - yvajotefihy.web.fc2.com

Long before Warren Buffett urged investors to be fearful when others are greedy and greedy when others are fearful, Vanderbilt embodied this philosophy by using steep market downturns to expand his holdings at sharp discounts.

Stiles in his Pulitzer Prize-winning biography of Vanderbilt, The First Tycoon. While the rest of the nation retrenched to lick their wounds in the ensuing depression, the thenyear-old businessman dispatched boats to crush his competitors in rate wars and launched a new state-of-the-art vessel named after himself.

He was able to do so in part because he was frugal.

The steamship trade was one of the most "aggressively competitive businesses in America" at the time, noted Stiles. But because Vanderbilt kept his costs low, he could make money even after slashing his prices to a fraction of his competitors.

Part of this was technological, as his newest steamships used half as much fuel as the older versions operated by his peers. Part of it was also achieved by shifting costs to customers, much like restaurants do by putting the onus on customers to compensate waiters and waitresses.

The fact that he carried little debt also mattered. By being better capitalized than other steamboat and railroad operators, Vanderbilt could absorb losses much more comfortably than competitors who had banks and bondholders breathing down their necks. He made it a habit as well to be flush with cash, the most valuable commodity at the nadir of an economic downturn. His maneuvering to take control of the Stonington Railroad between and serves as a textbook illustration of how he used these strengths to build his empires.

The Stonington served as a critical link between New York and Boston. Steamboats would depart Manhattan, travel through the Long Island Sound, and then drop passengers off in Stonington, Conn.

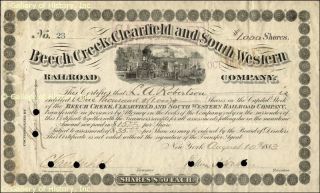

After the railroad teamed up with Vanderbilt's competitors to offer lower consolidated fares for the trip, and thereby threatening the Commodore's steamship lines in the area, the burgeoning millionaire set his sights on running the highly leveraged Stonington into the ground through a cut-throat rate war. As word of the war splashed across newspapers in New York and New England, the Stonington's stock plummeted.

Vanderbilt bought up enough of its now-discounted shares to seize five seats on the board in One year later, he named himself president of the branch line. His coup was complete, and he was able to accomplish it for pennies on the dollar by acquiring Stonington's stock when everyone else thought it was going to zero. Vanderbilt used this maneuver time and again over subsequent decades to build the biggest and most powerful company in the country at the time, the New York Central, which lives on even to this day via Vanderbilt's crowning masterpiece, Grand Central Station.

The lesson in all of this is that market swoons, like the one we're currently experiencing, are nothing to be afraid of. If you position yourself appropriately by keeping cash on hand and avoiding debt particularly margin debt in your brokerage account , these are the opportunities to double down on great companies at attractive prices.

Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy. John has written for The Motley Fool since If you like what you see, then you should follow him on Twitter. Skip to main content The Motley Fool Fool. Premium Advice Help Fool Answers Contact Us Login.

The fame and folly of cornering a market - Vanderbilt and the railroads (2) - FORTUNE

Latest Stock Picks Stocks Premium Services. Stock Advisor Flagship service. Rule Breakers High-growth stocks.

Cornelius Vanderbilt - The New York Times

Income Investor Dividend stocks. Hidden Gems Small-cap stocks.

Inside Value Undervalued stocks. Learn How to Invest. Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards.

Mortgages Compare Mortgage Rates Get Pre-Approved How Much House Can I Afford? Taxes How to Reduce Your Taxes Deductions Even Pros Overlook Audit-Proof Your Tax Return What Info Should I Keep? Helping the World Invest — Better. How to Invest Learn How to Invest. Personal Finance Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards.

Sep 2, at Prev 1 2 3 4 Next. Motley Fool push notifications are finally here Allow push notifications to help you stay on top of Breaking investing news Earnings coverage Market movers Special offers and more Subscribe to notifications You can unsubscribe at any time.