Forex money management rules

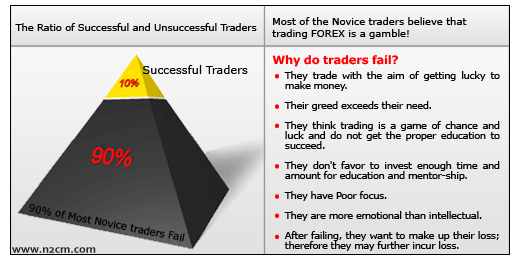

Understanding how to implement Forex trading money management to grow your trading account is essential to the success of all traders. However, many beginning traders are largely unaware of some or most of the basic concepts of effective Forex money management, and this is a major reason why so many traders fail to make money over the long-term in the markets.

This article will cover five topics that every trader should be keenly aware of in order to grow their trading account as efficiently as possible. For more information on each of the five topics discussed below, check out the links contained within each topic. You should use this article as a starting point to understand Forex trading money management, and refer back to as needed to solidify your comprehension of each topic discussed.

I get a lot of emails from traders asking me how much they should risk per trade, or what percentage of their trading account they should risk per trade. A good place to start when trying to determine how much to risk per trade is to honestly answering this question: I am not implying trading is entertainment, I am just trying to convey the point that you should only trade with money you truly do not need.

Next, when determining how much you should risk on a trade, always think in terms of dollars risked, not in pips. The notion that a trader should think in terms of pips instead of dollars is simply not conducive to effective Forex trading money management.

Pips are basically irrelevant because one trader could risk the same amount of pips as another trader but they could have drastically different dollar amounts at risk, this is a result of position sizing and will be discussed below. In my own personal approach I take a more discretionary approach to how much I will risk on any given trade, this is contrary to what the popular Forex web presence might say.

I typically risk a set amount of dollars per trade, rather than a set risk percentage, this approach works for me because I have mastered my trading edge, which is price action , and so I know exactly what I am looking for in the markets.

For more on this approach please click on the link in the previous paragraph. Indeed, it is so powerful that you can even enter the market essentially randomly and not lose money over the long run, and perhaps even turn a small profit, through the proper execution of risk reward.

For more on this idea see this article: A Case Study of Random Entry and Risk Reward in Forex Trading. Unfortunately many traders take the wrong approach to risk reward by worrying first about the potential reward and last about the potential risk.

You need to first calculate the risk involved on any potential trade setup AFTER you determine the most logical place to put your stop loss. Once you have done this, you then can determine what the potential reward is based on multiples of your dollar amount risked.

R would be 1: The idea is that if you can make at least 2 times your risk on all your winning trades, you will, over a series of trades, offset your losers to the point of turning a decent profit.

For more on the topic of risk reward see this article: Many traders do not understand position sizing, but it is a very simple concept that you must understand if you want to effectively manage your money. Position sizing allows you to risk the same amount of money no matter what price action trading strategy you trade or how large or small your stop loss distance is. Some traders erroneously believe that by having a wider stop loss on a trade they are risking more money or that by having a smaller stop loss on a trade they are risking less money.

The truth of the matter is that you can adjust your position size up or down to meet the necessary stop loss distance. So, you first should determine the most logical place to put your stop on a trade setup, you never want to determine your position size first, this should always come AFTER you determine the best and safest place for your stop. After figuring out where to place your stop loss, you THEN calculate the number of lots you can trade to maintain your pre-determined risk amount.

This is the correct way to maintain your risk on any trade; it is a basic but essential component to an effective Forex money management plan.

For more on position sizing check out this article: I often discuss the importance of managing your emotions while trading the Forex market. This is a very important factor of successful trading, but it is something that depends heavily on correct Forex trading money management. There is a reinforcing loop between money management and emotion management, and it can go either way. For example, the better you manage your risk and money in the Forex market, the easier it becomes to manage your emotions, simply because if you are effectively managing your money you are unlikely to become emotional.

Finally, in order to truly exploit all of the above topics, you need to truly master your Forex trading strategy.

Experienced traders like myself know that trading less often than most amateurs is conducive to growing their trading account. Put simply, there is no reason to trade if there is no reason to trade. All of the above money management principals are best taken advantage of when you are confident in your trading strategy and have no doubts in your mind about what the market should look like before you risk your money in it.

Essentially, domination of your chosen Forex trading strategy will tie all of the pieces of money management together and make them work in your favor. If you want to know more about how I trade the Forex market with simple price action trading strategies, check out my Price Action Forex trading course.

Top 10 Forex money management tips

Heavy readers will see that I give heavy praise sincere! I get improved daily through your lesson. Many many thanks Don. Great article, great site indeed. I decided to test your article back a month or two on risk reward and trading by flipping a coin.

I stopped trading with real money and went to demo trading only. For the month of Feb I traded price action setups and got 8 wins, 8 losses, for a net profit of pips. Did the same thing in March. I took every valid trade on demo and I got 13 wins, 6 losses, and made over pips. I see now that my fear of having a losing trade is what has held me back for so long. I now see that we all have losing trades and we just have to consider losses as part of the math which leads us to profit through risk reward.

A stroke of genius Nial. This concise article distills the Laws of Trading which I have spent 4 years researching the world of FX. If you value your trading account and emotional equilibrium please read this article at least 10 times.

I wish I had that opportunity 4 years ago.

You seriously have my attention! A very good explanation of concepts which are vital to understand and apply if one is to have any chance of becoming a competent trader as opposed to just a gambler. After two years of extensive reading and study you provide the best analysis and instruction I have seen.

I will definitely enroll on your course. If this is an example of what you are prepared to voluntarily provide for us then your course instruction must be very good indeed. Nial is at it again, and this time it deserves 50 Stars. I for one find myself playing video game with my trading platform too often. This will keep you on track. Good job Nial Fuller. Nice article Nial — thanks for putting things down to the nitty gritty in trade management. WHAT CAN I SAY , NIAL…ANOTHER PLATINUM HIT!

Your lessons are the oil for my turning gears. My trading is going well because of your articles. Your email address will not be published.

Notify me of follow-up comments by email. Notify me of new posts by email.

Trade Forex 1 Minute Daily

Any Advice or information on this website is General Advice Only - It does not take into account your personal circumstances, please do not trade or invest based solely on this information. By Viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by Learn To Trade The Market Pty Ltd, it's employees, directors or fellow members.

Futures, options, and spot currency trading have large potential rewards, but also large potential risk.

You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

Understanding Forex Risk Management

Forex, Futures, and Options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you.

You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose.

Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice.

We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results.

How much should I risk on a trade? Position sizing Many traders do not understand position sizing, but it is a very simple concept that you must understand if you want to effectively manage your money. How effective money management helps you manage your emotions I often discuss the importance of managing your emotions while trading the Forex market.

Master your Forex trading strategy Finally, in order to truly exploit all of the above topics, you need to truly master your Forex trading strategy. Related Trading Lessons Cure Emotional Trading Problems with Price Action Trading Trading Higher Time Frames Drastically Increases Trading Success.

Now I want to hear from you! October 5, at 8: March 18, at 6: November 17, at July 26, at 1: April 30, at 9: April 9, at April 5, at 8: April 5, at 6: April 5, at 2: April 3, at April 3, at 9: April 3, at 2: April 2, at April 2, at 8: April 2, at 7: April 2, at 6: April 2, at 3: April 2, at 2: Leave a Comment Cancel reply Your email address will not be published. Why You Should Take the Profits and Run!

What I Learned After Taking Three Months Off From Trading Why Trading Against the Trend Will Destroy Your Account Why You Should Have a Favorite Market to Trade What Your Future Trading Self Would Tell You 10 Years From Now Let The Market Take You Out Of Your Trade The Psychology of Trade Profit Targets 10 Reasons Traders Fail to Make Money Trading A Simple Plan To Exit Your Trades Successfully 3 Ideas That Transformed My Trading Career The Power of The Pull Back Trading Strategy How To Anticipate Your Next Trade.

Categories Forex Trading Commentary Forex Trading Videos Forex Trading Strategies Forex Trading Articles Trading Lessons Blog Forex Trading Blog Trading Tools. Nial Fuller Learn To Trade Forex Price Action Trading Nial Fuller Reviews Beginners Forex Trading New York Close Charts Forex Broker. Copyright Learn To Trade The Market.