Commodity channel index trading system

The Commodity Channel Index indicator was designed by Donald Lambert and fits into the category of being a momentum indicator for those involved in technical analysis. Due to the lines on the indicator, it is often used as an oversold and overbought indicator. That can often be a flawed use of the CCI considering it is a momentum oscillator that is designed to show momentum in the market. It stands to reason that if a market has enough momentum to drive the CCI into overbought territory, that indicates the market is strong.

Some will argue that an overbought market is in line to reverse at least temporarily.

Commodity Channel Index (CCI) [ChartSchool]

The designer, Donald Lambert, actually looked at oversold or overbought conditions as a reason to trade in that direction with the theory that strength in the market is a good thing. The same techniques apply to short positions at the line.

You can modify the CCI to set your own parameters. You just have to rely on a trading plan that has specific criteria for entering the market so you are not depending on a lagging indicator for the basis of your trading.

The good thing is that most charting platforms have the CCI built into their indicator selection.

It never hurts to have an understanding of how the CCI is calculated to help you fully understand the nuances of this trading indicator. Keep in mind that some traders may alter how the typical price is calculated but for now, just focus on the accepted calculation.

How to Day Trade with the Commodity Channel Index (CCI) - Tradingsim

The use of a. What that means that if the Commodity Channel Index heads into the oversold or overbought condition, that is outside the normal fluctuations of a market. That indicates strength or weakness and is a good time to either place a trade or exit one you are currently in.

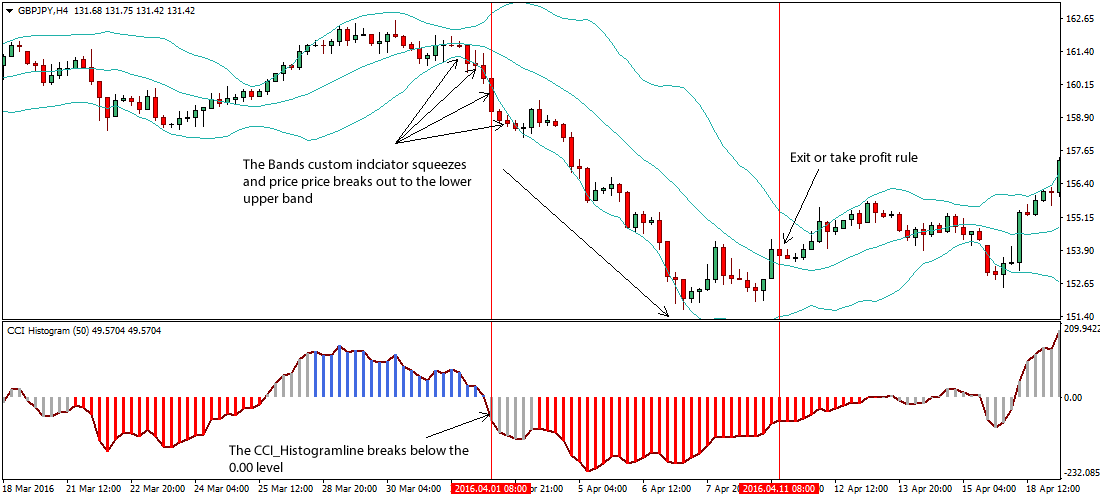

To summarize so far: It the CCI reads overbought or oversold then this tells you that the price has exceeded the normal price movement the standard deviation away from the average. If you were to follow the trading signals generated by CCI, without any other technical analysis or price action study, then these are the problems you will encounter as shown by the chart below:. So can we tie all the good things about the CCI into something that we can actually trade as a Forex strategy?

The logic for this is very simple: The CCI cannot tell you about the trend but can tell you about the strength of the trend. So to help put the odds in our favor, we are going to look to price action trading to help lessen the lagging issue with all indicators. You first should fully understand how to draw support and resistance levels on your chart.

These will give you an objective location to begin looking for a trading setup. It is also a good idea to confirm these with bearish reversal candlestick patterns to go short when trading the bounce of a resistance level like shown on the chart below:. Mail will not be published required.

A Simple CCI Strategy for Scalpers

You can use these tags: How To Calculate CCI The good thing is that most charting platforms have the CCI built into their indicator selection. Here is how Lambert explained that figure: Oscillators tend to have levels that indicates overbought or oversold.

Commodity Channel Index (CCI) [ChartSchool]

The CCI oscillates below and above zero level. When the Commodity channel index reads then the market or price at the time is considered oversold.

Price Action Trading School: RSI and CCI in DepthThe CCI is a lagging indicator To summarize so far: PROBLEMS WITH USING CCI TO TRADE If you were to follow the trading signals generated by CCI, without any other technical analysis or price action study, then these are the problems you will encounter as shown by the chart below: Commodity Channel Index Trade Examples.

How To Trade CCI With Moving Averages. Commodity Channel Index Trading With Support And Resistance Levels.

Posted in Swing Trading Lessons. Leave a Reply Click here to cancel reply. Powered by WordPress Designed by: Free WordPress Themes Thanks to Best WordPress Themes , Best Wordpress Hosting and Promo Codes.