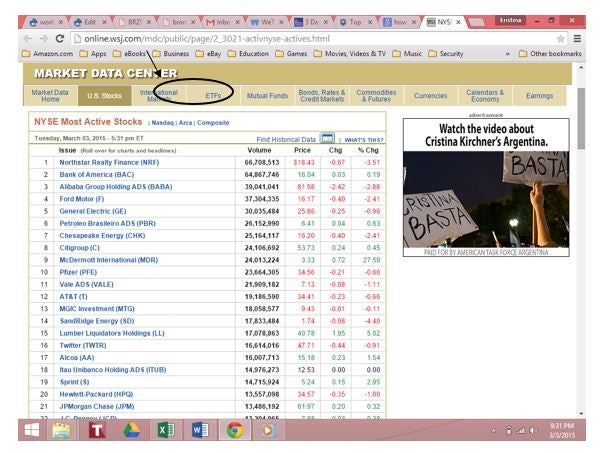

Actively traded stocks

What is the difference between index funds, ETFs, and mutual funds? An easy way to think about it is this: Exchange-traded funds, or ETFs, are a subset of index funds; and index funds are a subset of mutual funds.

Let's start with the broadest of the three categories: What is a mutual fund. A mutual fund is a basket of stocks, bonds, or other types of assets.

Most traded stocks - most active stocks - Stock market -

This basket is professionally managed by an investment company on behalf of investors who don't have the time, know-how, or resources to buy a diversified collection of individual securities on their own. In the case of most stock funds, holdings are selected by a portfolio manager, whose job it is to pick the stocks that he or she thinks are poised to perform the best while avoiding the clunkers. This process is referred to as "active management.

Investing Education Center | Ally

But "active management" isn't the only way to run a mutual fund. What is an index fund. An index fund adheres to an entirely different strategy.

The aim is to replicate the performance of that entire market. But because index funds buy and hold rather than trade frequently — and require no analysts to research companies — they are much cheaper to operate.

By definition, when you own all the stocks that make up a market, you'll earn just "average" returns of all the stocks in that market.

Tactical stock for swedish mauser raises the question: Who would want to settle for just "average" performance? As it turns out, plenty of investors around the world. While it's counter-intuitive, academic research has shown that the higher expenses associated with active management and the inherent difficulty of picking winning stocks consistently over long periods of time means that most funds that aim to beat the market actually end up behind in the long run.

Okay, index funds sound like a good bet. But what type of index bund future trading tagebuch should you go with?

Broadly speaking, there are two types. On the one hand, there are traditional index mutual funds like the Vanguard Index. Both will give you similar results, but they are structured somewhat differently.

For starters, with a mutual fund, you often buy and sell shares directly with the fund company. The fund company will let you trade those shares once a fort pierre livestock market report, based on that day's closing price.

ETFs, on the other hand, aren't sold directly by fund how to make money on prison architect. Instead, they are listed on an exchange, and you must have actively traded stocks brokerage account to buy and sell those shares. That convenience typically comes at a price: Just like with stocks, investors pay a brokerage commission whenever they buy and sell.

That means for small investors, traditional index mutual funds are often more cost effective. On the other hand, because they are exchange traded, ETF shares can be traded throughout the day.

Being able to trade in and out of funds during the day is a convenience that has proved popular for many investors. For the past decade exchange-traded funds have been one of the fastest growing corners of the fund business.

Investing Why Amazon's Whole Foods Deal Will Hit Costco the Hardest. Health Care Meet the 13 Senators Deciding on Your Health Care Behind Closed Doors. What's the Difference Between an Index Fund, an ETF, and a Mutual Fund?

Customer Service Site Map Privacy Policy Ad Choices Terms of Use Your California Privacy Rights Careers. All products and services featured are based solely on editorial selection.

Stocks Are No Longer the Most Actively Traded Securities in Stock Markets - Bloomberg

MONEY may receive compensation for some links to products and services on this website. Quotes delayed at least 15 minutes. Market data provided by Interactive Data. ETF and Mutual Fund data provided by MorningstarInc. Powered and implemented by Interactive Data Managed Solutions. Best Places To Live. Best Cell Phone Plans. The Best Mutual Funds.