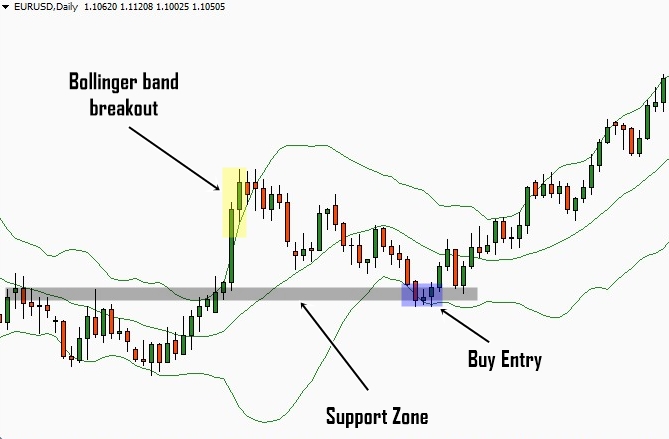

Breakout bollinger bands

Check out this quick video on bollinger bands. The video will help you familiarize yourself with the indicator and provide a general overview of trade setups before we dig into the advanced strategies. Odds are you have landed on this page in search of bollinger band trading strategies , secrets, best bands to use, or my favorite - the art of the bollinger band squeeze.

Before you skip down to the section titled bollinger band trading strategies which covers all these topics and more; let me impart two additional resources on Tradingsim: At the end of this article, you will not only learn six bollinger band trading strategies, but more importantly, you will understand which strategy best matches your trading profile.

Bollinger bands are a powerful technical indicator created by John Bollinger. Some traders will swear that solely trading a bollinger bands strategy is the key to their success. Bollinger bands encapsulate the price movement of a stock.

It provides relative boundaries of highs and lows. The crux of the bollinger band indicator is based on a moving average that defines the intermediate-term "trend" of the stock based on the trading time frame you are viewing. This trend indicator is known as the middle band. Most stock charting applications use a period moving average for the default bollinger bands settings.

The upper and lower bands are then a measure of volatility to the upside and downside. They are calculated as two standard deviations from the middle band. Many of you have heard of popular technical analysis patterns such as double tops , double bottoms, ascending triangles, symmetrical triangles , head and shoulders top or bottom, etc. The bollinger bands indicator can add that extra bit of firepower to your analysis by assessing the potential strength of these formations. Bollinger bands can help you understand whether or not the stock is trending, or even if it is volatile enough for your investment.

Many times, large rallies begin from low volatility ranges. When this happens, it is referred to as "building cause. Before we jump into the strategies, take a look at the below infographic titled '15 Things to Know about Bollinger Bands'.

The information contained in the graphic will help you better understand the more advanced techniques detailed later in this article. The initial bottom of this formation tends to have substantial volume and a sharp price pullback that closes outside of the lower bollinger band. These types of moves typically lead to what is called an "automatic rally. After the rally commences, the price attempts to retest the most recent lows that have been set to test the vigor of the buying pressure that came in at that bottom.

Many bollinger band technicians look for this retest bar to print inside the lower band. This indicates that the downward pressure in the stock has subsided and there is a shift from sellers to buyers. Below is an example of the double bottom outside of the lower band which generates an automatic rally.

The setup in question was for FSLR from June 30, To top things off, the candlestick struggled to close outside of the bands.

How do traders use Bollinger Bands® to identify a breakout? | Investopedia

Another simple, yet effective trading method is fading stocks when they begin printing outside of the bands. Now, let's take that one step further and apply a little candlestick analysis to this strategy.

For example, instead of shorting a stock as it gaps up through its upper band limit, wait to see how that stock performs. If the stock gaps up and then closes near its low and is still completely outside of the bollinger bands, this is often a good indicator that the stock will correct on the near-term.

You can then take a short position with three target exit areas: In the below chart example, the Direxion Daily Small Cap Bull 3x Shares TNA from June 29, , had a nice gap in the morning outside of the bands but closed 1 penny off the low.

As you can see in the chart, the candlestick looked terrible.

The single biggest mistake that many bollinger band novices make is that they sell the stock when the price touches the upper band or buy when it reaches the lower band.

Bollinger himself stated that a touch of the upper band or lower band does not constitute a bollinger band signals of buy or sell. Take a look at the example below and notice the tightening of the bollinger bands right before the breakout. Notice how the volume exploded on the breakout and the price began to trend outside of the bands. These can be hugely profitable setups, if you give them room to fly. I want to touch on the middle band again. Just as a reminder, the middle band is set as a period simple moving average in many charting applications.

Every stock is different, and some will respect the 20 period and some will not. In some cases, you will need to modify the simple moving average to a number that the stock respects. This is curve fitting, but we want to put the odds in our favor.

While curve fitting can work, you have to make sure you don't go crazy with analyzing corky settings. At any rate, the middle line can represent areas of support on pullbacks when the stock is riding the bands. You could even increase your position in the stock when the price pulls back to the middle line.

Conversely, the failure for the stock to continue to accelerate outside of the bollinger bands indicates a weakening in the strength of the stock. This would be a good time to think about scaling out of a position or getting out entirely.

Another bollinger bands trading strategy is to gauge the initiation of an upcoming squeeze. John created an indicator known as the band width. The idea, using daily charts, is that when the indicator reaches its lowest level in 6 months, you can expect the volatility to increase. This goes back to the tightening of the bands that I mentioned above. This squeezing action of the bollinger band indicator foreshadows a big move.

You can use additional signs such as volume expanding, or the accumulation distribution indicator turning up. We need to have an edge though when trading a bollinger band squeeze because these types of setups can head-fake the best of us. It immediately reversed, and all the breakout traders were head faked. You don't have to squeeze every penny out of a trade. Wait for some confirmation of the breakout and then go with it.

If you are right, it will go much further in your direction. Notice how the price and volume broke when approaching the head fake highs yellow line. To the point of waiting for confirmation, let's take a look at how to use the power of a bollinger band squeeze to our advantage. Below is a 5-minute chart of Research in Motion Limited RIMM from June 17, Notice how leading up to the morning gap the bands were extremely tight. Now some traders can take the elementary trading approach of shorting the stock on the open with the assumption that the amount of energy developed during the tightness of the bands will carry the stock much lower.

Another approach is to wait for confirmation of this belief. So, the way to handle this sort of setup is to 1 wait for the candlestick to come back inside of the bollinger bands and 2 make sure there are a few inside bars that do not break the low of the first bar and 3 short on the break of the low of the first candlestick.

Based on reading these three requirements you can imagine this does not happen very often in the market, but when it does, it's something else. The below chart depicts this approach. Now let's take a look at the same sort of setup but on the long side.

Below is a snapshot of Google from April 26, Notice how GOOG gapped up over the upper band on the open, had a small retracement back inside of the bands, then later exceeded the high of the first candlestick. These sort of setups can prove powerful if they end up riding the bands.

This strategy is for those of us that like to ask for very little from the markets. Essentially you are waiting for the market to bounce off the bands back to the middle line. You are not obsessed with getting in a position and it wildly swinging in your favor. Nor are you looking to be a prophet of sorts and try to predict how far a stock should or should not run.

By not asking for much, you will be able to safely pull money out of the market on a consistent basis and ultimately reduce the wild fluctuations of your account balance, which is common for traders that take big risks.

The key to this strategy is waiting on a test of the mid-line before entering the position. You can increase your likelihood of placing a winning trade if you go in the direction of the primary trend and there is a sizable amount of volatility.

As you can see in the above example, notice how the stock had a sharp run-up, only to pull back to the mid-line. You would want to enter the position after the failed attempt to break to the downside.

You can then sell the position on a test of the upper band. If you have more of an appetite for risk, you can ride the bands to determine where to exit the position. This is honestly my favorite of the strategies. If I gave you any other indication that I preferred one of the other signals, forget whatever I said earlier.

First, you need to find a stock that is stuck in a trading range.

Profiting From The Bollinger Squeeze

The greater the range, the better. Now, looking at this chart, I feel a sense of boredom coming over me. However, from my experience, the guys that take money out of the market when it presents itself, are the ones sitting with a big pile of cash at the end of the day.

In the above example, you just buy when a stock tests the low end of its range and the lower band. Conversely, you sell when the stock tests the high of the range and the upper band. The key to this strategy is a stock having a clearly defined trading range.

This way you are not trading the bands blindly, but are using the bands as a means to gauge when a stock has gone too far. You could argue that you don't need the bands to execute this strategy.

However, by having the bands, you can validate that a security is actually in a flat or low volatility phase, by reviewing the look and feel of the bands. So, instead of trying to win big, you just play the range and collect all your pennies on each price swing of the stock. For me, it's strategy number 6 hands down, because you are constantly taking money out of the market and it has a high winning percentage. Because you are not asking much from the market in terms of price movement.

From my personal experience of placing thousands of trades, the more profit you search for in the market, the less likely you will be right.

Since trading is a personal journey, some of the other approaches may work best for your risk profile. Below is a quick list of the trading styles and which ones are best aligned to the six strategies covered in this article:.

Like anything else in the market, there are no guarantees. Bollinger bands can be a great tool for identifying volatility in a security, but it can also prove to be a nightmare when it comes to newbie traders. Don't skip ahead, but I will touch on this from my personal experience a little later in this article. Not exiting your trade can almost prove disastrous as three of the aforementioned strategies are trying to capture the benefits of a volatility spike. For example, imagine you are short a stock that reverses back to the highs and begins riding the bands.

What would you do? While bands do a great job of encapsulating price movement, it only takes one extremely volatile stock to show you the bands are nothing more than man's failed attempt to control the uncontrollable. These are not hard fast rules, but things you need to consider as you validate if the indicator is a good fit for you and your trading style.

Regardless of the trading platform, you will likely see a settings window similar to the following when logging into the application. If you are new to trading, you are going to lose money at some point. This process of losing money often leads to over-analysis. While technical analysis affords us the ability to identify things unseen on a ticker, it can also aid in our demise.

In the old times, there was little to analyze. Therefore, you could tweak your system to a degree, but not in the way we can continually tweak and refine our trading approach today. Case in point, the settings of the bollinger bands indicator. While the configuration is far simpler than many other indicators , it still provides you the ability to run unlimited optimization tests to try and squeeze out the last bit of juice from the stock.

The problem with this approach is after you change the length to My strong advice to you is to not tweak the settings at all. It's actually better to stick with 20, as this is the setting all the traders are using anyways to make their decisions.

I always like to know what's coming at me versus trying to look for some secret setting that does not exist. Pairing the bollinger band width indicator with bollinger bands is like combining the perfect red wine and meat combo you can find. In the previous section, we talked about staying away from changing the settings. Well, if you really think about it, your entire reasoning for changing the settings in the first place is in hopes of identifying how a particular security is likely to move based on its volatility.

A much easier way of doing this is to use the bollinger bands width. In short the the bb width indicator measures the spread of the bands to the moving average to gauge the volatility of a stock. Well, now you have an actual reading of the volatility of a security, which you can then use to look back over months or years to see if there is any repeatable patterns of how price reacts when it hits extremes.

Still don't believe me? Take a look at the below screenshot using both the bollinger bands and bollinger band width. Notice how the bollinger band width tested the. The other point of note is that on each prior test, the high of the indicator made a new high, which implied the volatility was expanding after each quiet period. As a trader, you need to separate the idea of a low reading with the bollinger bands width indicator with the decrease in price.

If you had just looked at the bollinger bands, it would be nearly impossible to know that a pending move was coming. You would have no way of knowing that. This is just another example of why it's important to pair bollinger bands with other indicators and not use it as a standalone tool. I think it's safe to say bollinger bands is probably one of the most popular technical indicators in any trading platform. If my memory serves me correctly, bollinger bands, moving averages and volume were likely my first taste of the life.

Well as of today, I no longer use bollinger bands in my trading. That doesn't mean that they can't work for you, I just found that my trading style requires me to use a clean chart. So, how did I end up abandoning the bands? Well, let me dig a little deeper so you can understand my rationale. Therefore, the more signals I have on a chart, the more likely I am to feel the need to take action in response to said signal.

This is where the bollinger bands expose my trading flaw. For example, if a stock explodes above the bands, what do you think is running through my mind? You guessed right, sell! In reality , the stock could just be starting its glorious move to the heavens, but I am unable to mentally handle the move because all I could think about was the stock needed to come back inside of the bands.

Instead of taking the time to practice, I was determined to turn a profit immediately and was testing out different ideas. I decided to scalp trade, and I would sell every time the price hit the top bands and buy when it hit the lower band. I know, don't judge me, it's pretty bad. From what I remember, I tried this technique for about a week, and at the end of this test, I had made Tradestation rich with commissions.

The key flaw in my approach is that I did not combine bollinger bands with any other indicator. This left me putting on so many trades that at the end day, my head was spinning. At the end of the day, bollinger bands are a means for measuring volatility. So, it's not something you can just pick up and use for buy and sell signals. Just as you need to learn specific price patterns, you also need to find out how bollinger bands respond to certain price movements.

This ability to identify the setups will help you avoid the false signals from the real ones. This level of mastery only comes from placing hundreds if not thousands of trades with the same markets on the same time frame. The thing that surprised me is that I couldn't find many other famous authors or experts in the space. I'm not sure if this is because there aren't many people interested or if other traders stay out of the bollinger bands arena because John is so actively evangelizing the bands.

The books I did find were written by "basement authors" and honestly have less material than what I have composed in this article. The other hint that made me think these authors were not legit, is their lack of the registered trademark symbol after the bollinger bands title, which is required by John for anything published related to bollinger bands. Conversely, when I search on Elliott Wave, I find a host of books and studies both on the web and in the Amazon store.

I am still unsure what this means exactly. With there being million of retail traders in the world, I have to believe there are a few that are crushing the market using bollinger bands.

Profiting From The Bollinger Squeeze

I just struggled to find any real thought leaders outside of John. I write this not to discredit or credit trading with bands, just to inform you of how bollinger bands are perceived in the trading community. Bollinger bands work well on all time frames. Remember, price action performs the same, just the scales of the moves are different. Without a doubt, the best market for bollinger bands is Forex.

I say this because currencies tend to move in a methodical fashion allowing you to measure the bands and size up the trade effectively. Next, I would rank futures because again you can begin to master the movement of a particular contract.

Last on the list would be equities. The captain obvious reason for this one is due to the unlimited trading opportunities you have at your fingertips.

It's one thing to know how the e-mini contract will respond to the lower band while in a five-day trading range. It's an entirely different story to have to size up one stock from the next in terms of how well a given security responds to the bands. There will be some stocks that simply do not care and do whatever the want. Learn to Day Trade 7x Faster Than Everyone Else Learn How. Free Trial Log In. Bollinger Bands Double Bottom. Reversals with Bollinger Bands. BSC Bollinger Band Example. Bollinger Bands Gap Down Strategy.

Bollinger Bands Gap Up Strategy. Middle of the Bands. Third Time's the Charm - Bollinger Band Width. How to Trade with the Tick Index — 2 Simple Strategies. Renko Charts — Japanese Charting Method.

Categories Candlesticks Chart Patterns Day Trading Basics Day Trading Indicators Day Trading Psychology Day Trading Software Day Trading Strategies Day Trading Videos Futures Glossary Infographics Investment Articles Swing Trading Trading Strategies. Customer Login Sign Up Contact Us. Login Sign Up Contact Us.