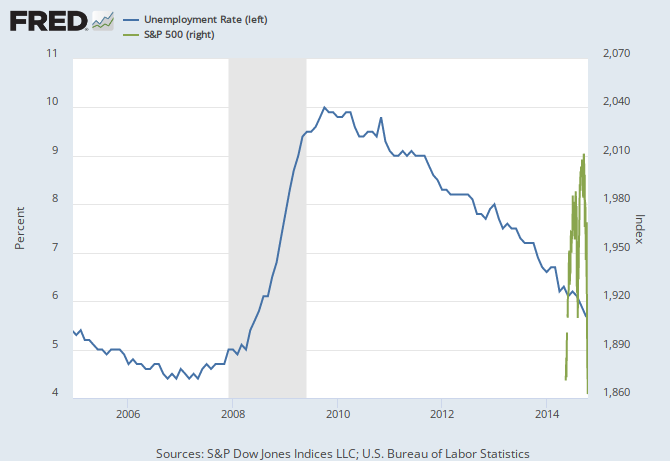

Average stock market decline during recession

In response to an email, I've updated the data in this article through the March month-end numbers and at the launch of the Q1 earnings season. When I initiated the dshort web page in late , one of my routine topics was equity valuations, initially inspired by Nobel laureate Robert Shiller's book, Irrational Exuberance , the second edition of which was published earlier that year.

A few years ago I began posting a monthly update featuring an overlay of the four. Here is a chart that shows the average of the four valuation indicators from a geometric mean regression. Last year I had a fascinating conversation with Neile Wolfe, of Wells Fargo Advisors , LLC.

The Dow A Look Into the Last Five Recessions

Based on the underlying data in the chart above, Neile made some cogent observations about the historical relationships between equity valuations, recessions and market prices:. Here is a table that highlights some of the key points.

The Dow A Look Into the Last Five Recessions

The rows are sorted by the valuation column. Beginning with the market peak before the epic Crash of , there have been fourteen recessions as defined by the National Bureau of Economic Research NBER.

The table above lists the recessions, the recession lengths, the valuation as documented in the chart illustration above , the peak-to-trough changes in market price and GDP.

S&P bear markets and recessions - Business Insider

I've included a row for our current valuation, through the end of March, to assist us in making an assessment of potential risk of a near-term recession. The valuation that preceded the Tech Bubble tops the list and was associated with a The largest decline, of course, was associated with the month recession that began in Our current market valuation puts us between the two. Here's an interesting calculation not included in the table: Of the nine market declines associated with recessions that started with valuations above the mean, the average decline was Of the four declines that began with valuations below the mean, the average was What are the Implications of Overvaluation for Portfolio Management?

Neile and I discussed his thoughts on the data in this table with respect to portfolio management. I came away with some key implications:. Equity markets can stay at lofty valuation levels for a very long time. Consider the chart posted above. There are months in the series with only 59 months of valuations more than two Standard Deviations STD above the mean.

Each month we update the four valuation indicators we routinely track. It will be interesting to see what the valuation level we've reviewed here looks like at the end of the Q1 earnings season.

Based on the underlying data in the chart above, Neile made some cogent observations about the historical relationships between equity valuations, recessions and market prices: High valuations lead to large stock market declines during recessions. During secular bull markets, modest overvaluation does not produce large stock market declines. During secular bear markets, modest overvaluation still produces large stock market declines.

I came away with some key implications: Given this scenario, over the next 7 to 10 years a buy and hold strategy may not meet the return assumptions that many investors have for their portfolio. Asset allocation in general and tactical asset allocation specifically are going to be THE important determinant of portfolio return during this time frame. Some market commentators argue that high long-term valuations e.

Indicators of Stock Market Crash Brewing! Silver Price Economic Collapse 2017. Caterpillar LayoffsHowever, the impact of elevated valuations — when it really matters — is expressed when the business cycle peaks and the next recession rolls around. Elevated valuations do not take a toll on portfolios so long as the economy is in expansion. How Long Can Periods of Overvaluation Last? Expansion Equity Stock Allocation Asset Allocation Factor Business Cycle. Week Month Year Trending.

11 historic bear markets - Business - Stocks & economy | NBC News

What Do We Know about Investor Irrationality? Small-Cap Mining Stocks, Big-Time Opportunity by Frank Holmes of U. Why the Future is Bright for AUM-Based Advisors by J. Jeremy Siegel — Why Long-term Investors Should Own Stocks: A Warning to the Advisory Profession: What Could Go Wrong?

Subscribe Newsletters Advertise Submissions About Us Privacy Contact Us.